Roth ira contribution calculator 2020

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. It is mainly intended for use by US.

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Know How Much Can You Contribute to an IRA And Make Sure You Have a Withdrawal Strategy.

. The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older. Explore Choices For Your IRA Now. Roth Ira Contribution Limit 2021 Calculator.

An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Does converting to a Roth IRA make sense for you. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. We Go Further Today To Help You Retire Tomorrow.

Get The Freedom To Plan For Your Income Needs And Legacy Goals. Skip to account login Skip to Main. 2020 Roth IRA Income Limits.

Roth IRA Conversion Calculator. It is important to. Open A Roth IRA Today.

This calculator assumes that you make your contribution at the beginning of each year. A Roth IRA calculator is an easy online tool to know the maturity amount of your periodical deposit of the the tax-paid amounts. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

New Look At Your Financial Strategy. Save for Retirement by Accessing Fidelitys Range of Investment Options. Invest With Schwab Today.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Open A Roth IRA Today. Multiply the maximum contribution limit before reduction by this adjustment and before reduction for any contributions to traditional IRAs by the result in 3.

Roth IRA Calculator Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Get Up To 600 When Funding A New IRA. Your Roth IRA contribution.

Roth Conversion Calculator Methodology General Context. Not everyone is eligible to contribute this. For tax year 2020 contributions are not allowed in the year in which you turn 70 12 or later.

Ad Learn About 2021 IRA Contribution Limits. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the. This limit applies across all.

We Go Further Today To Help You Retire Tomorrow. Ad Explore Your Choices For Your IRA. IRA Calculator The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings.

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. Save for Retirement by Accessing Fidelitys Range of Investment Options.

Get Up To 600 When. For some investors this could prove. Well walk you through the important considerations before initiating a Roth IRA conversion.

The same combined contribution limit applies to all of your Roth and traditional IRAs. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. Limits on Roth IRA contributions based on modified AGI.

Ad Learn About the Traditional and Roth IRAs and Their Contribution Limits. Ad Learn About 2021 IRA Contribution Limits. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

Visit The Official Edward Jones Site. Find out using our IRA Contribution Limits Calculator. You can adjust that contribution.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. During the 2022 tax year your Roth IRA contribution is phased out based on MAGI. For comparison purposes Roth.

Get Up To 600 When Funding A New IRA. Full contribution if MAGI is less than 129000 single or 204000 joint Partial contribution if.

Traditional Vs Roth Ira Calculator

Backdoor Roth Ira 2021 A Step By Step Guide With Vanguard Physician On Fire Roth Ira Vanguard Roth

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Pin On Usa Tax Code Blog

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Contributing To Your Ira Start Early Know Your Limits Fidelity

Roth Ira Calculator Roth Ira Contribution

What Is The Best Roth Ira Calculator District Capital Management

Historical Roth Ira Contribution Limits Since The Beginning

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

What Are Roth Ira Accounts Nerdwallet Roth Ira Ira Investment Individual Retirement Account

Roth Ira Calculator How Much Could My Roth Ira Be Worth

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

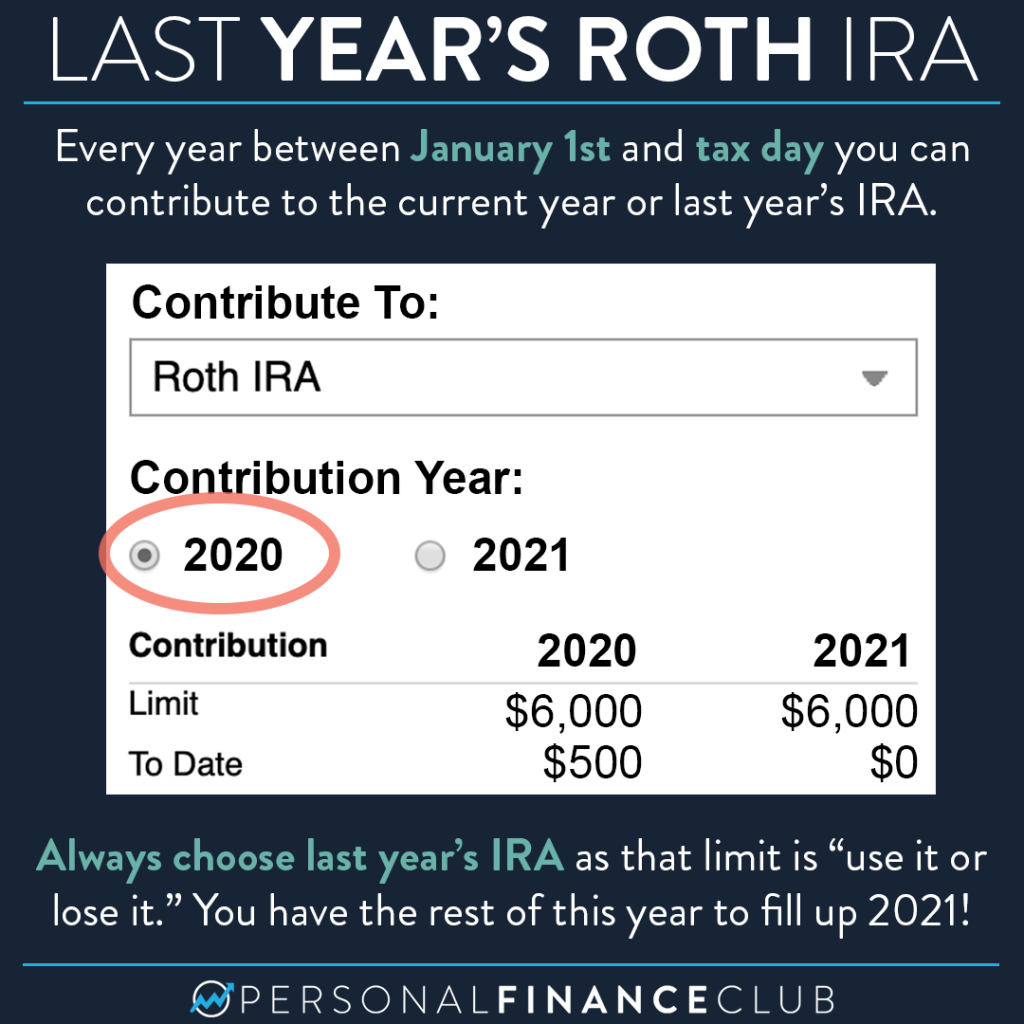

Can I Still Contribute To My 2020 Roth Ira Personal Finance Club